are campaign contributions tax deductible in 2019

Campaign contributions and the tax implications. But it may be tough to deduct those contributions for tax purposes.

Are Political Donations Tax Deductible Credit Karma

You can obtain these publications free of charge by calling 800-829-3676.

. The bottom line is if you dont itemize and take the standard deduction you cant deduct charitable donations. Are Political Contributions Tax-Deductible. As a result you may not itemize deductions this year even if youve consistently done so in the past.

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. After years of public service federal retirees may want to continue giving. Are campaign contributions tax deductible in 2019.

For 2019 the standard deduction is 12200 for single filers and 24400 for joint filers. In most states you cant deduct political contributions but four states do allow a tax break for political campaign contributions or donations made to political candidates. Following special tax law changes made earlier this year cash donations of up to 300 made before December 31 2020 are now.

In 2009 about two-thirds of candidates surveyed said that the states tax credit program brought in new donors. The amount an individual can contribute to a candidate for each election was increased to 2800 per election up from 2700. The main problem for most people is having enough deductions to itemize their charitable donations.

Arkansas Ohio and Oregon offer a tax credit while Montana offers a tax deduction. Presidential Election Campaign Fund. Are campaign expenses tax deductible.

Generally you may deduct up to 50 percent of your adjusted gross income but 20 percent and 30 percent limitations apply in some cases. OPM sent out a message that states. Since each primary and the general election count as separate elections individuals may give 5600 per candidate per cycle.

All four states have rules and limitations around the tax break. And businesses are limited to deducting only a portion. The Internal Revenue Service has a special new provision that will allow more people to easily deduct up to 300 in donations to qualifying charities this year even if they dont itemize.

You cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. The per-calendar year limits became effective on January 1 2019.

According to OPM you can deduct even if you take the standard deduction and do not itemize. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. Donations utilized before or after the campaign period also do not qualify for donors tax exemption and allowable deduction.

How much should a Monstera plant cost. The Combined Federal Campaign CFC is one of the largest and most successful workplace fundraising campaigns in the world. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductibleThis means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these.

The other 39 states restrict the amount of money that any one individual can contribute to a state campaign. These limits are typically dependent upon the office the candidate seeks. Before you go any further assess your.

For example Connecticut restricts individual spending to 1000 for a candidate in a state senate race and 250 for a candidate for a state house seat. Thanks to the 2017 Tax Cuts and Jobs Act married couples filing jointly need at least 24400 in deductions on their taxes for 2019 to make itemizing worthwhile. WRONG for 2020.

For example contributions by individuals of more than 200 in a year must be disclosed to the FEC within as few as 20 days. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate are not deductible it says in IRS Publication 529. Contribution amounts are often limited and the contributions are not tax-deductible.

State and local sales tax and other deductible taxes. Joint filers can claim up to 100. You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate.

31-2019 meanwhile reiterates the issuance of non-VAT official receipts for every contribution received whether in cash or in kind valued at fair market value. According to the IRS the answer is a very clear NO. The information in this article is up to date through tax year 2019 taxes filed.

As circularized in Revenue Memorandum Circular RMC 38-2018 and as reiterated in RMC 31-2019 campaign contributions are not included in the taxable income of the candidate to whom they were given the reason being that such contributions were given not for the personal expenditure or enrichment of the concerned candidate but for the purpose of utilizing. The FEC website then shows the donors name address occupation and amount given. In Minnesota a registered voter can claim a Political Contribution Refund equal to her donation to a state-level candidate or Minnesota political party up to 50.

Special 300 Tax Deduction. In relation to this RMC 38-2018 provides that only those donationscontributions that have been utilizedspent during the campaign period as set by the Comelec are exempt from donors tax. If you have made contributions donations or payments for any of these that amount cant be deducted from your taxes.

Generally individuals cant deduct business entertainment expenses until the 2026 tax year thanks to tax reform. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contributions on the part of the donor.

Tracking 30 Investigations Related To Trump The New York Times

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Taxability Of Campaign Contributions

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

Campaign Funding Explained How Are Political Campaigns Financed Caltech Science Exchange

Elon Musk Tesla Spacex Spend Millions To Influence Politics And Policy

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

The Irs Is Not Enforcing The Law On Political Nonprofit Disclosure Violations Crew Citizens For Responsibility And Ethics In Washington

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

As Its Revenue Dropped The Nra Took Millions Of Dollars From Its Charities And Funded Political Groups Opensecrets

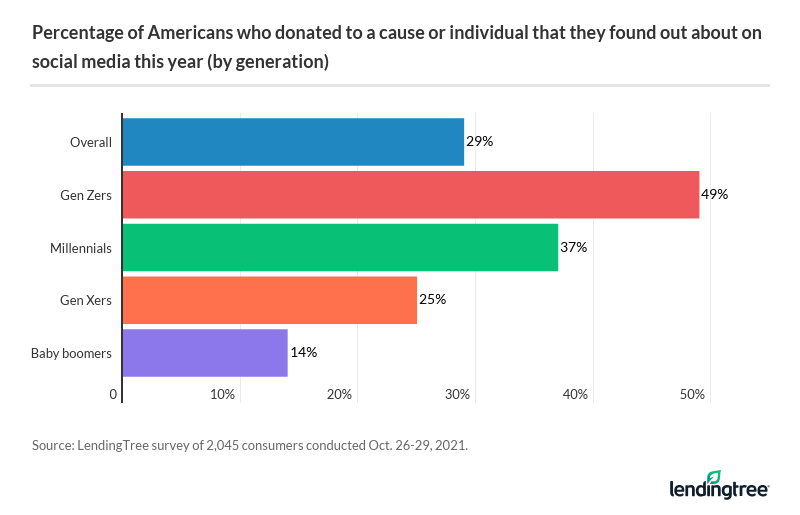

56 Of Americans Donated To Charity In 2021 Lendingtree

Campaign Finance Info Pittsburghpa Gov

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

What Is The Combined Federal Campaign Article The United States Army